There are two ways to get the Pos Malaysia’s POSperity Parade Angpow Packet:

- Gift With Purchase (GWP) – FREE one (1) POSperity Parade Angpow packet with a minimum spend of RM20 in a single receipt at Pos Shop OR

- Purchase 1 packet of Angpow (10 pcs) at RM5.80.

You may purchase it at Pos Shop outlets, for a limited time starting from 27 January 2026, while stocks last. Payment options include Cash, QR payment, Debit Card and Credit Card. Payment using voucher is not allowed.

- Each qualifying receipt is entitled to one (1) FREE angpow packet only, regardless of total spend (eg RM40, RM60, RM80, and above).

- Minimum spend of RM20 must be in one (1) single receipt within the promotion period.

- Redemption is valid from 27 January 2026, while stocks last.

- GWP redemption is not applicable for the following transactions/purchases:

- Pos Malaysia official merchandise

- Bill payments

- Mobile topups

- Cigarettes and tobacco products

- Electronic items

- Payment using vouchers is not allowed

- Combining receipts from different days is not allowed

Yes. Customers may purchase the angpow packet at RM5.80 and still receive the free GWP, as long as the RM20 minimum spend is met in the same receipt.

Terdapat dua cara untuk mendapatkan Paket Angpow POSPerity Parade Pos Malaysia:

- Gift With Purchase (GWP) – Percuma satu (1) paket Angpow POSperity Parade dengan perbelanjaan minimum RM20 di Pos Shop dalam satu resit.

- Beli 1 paket Angpow (10 keping) pada harga RM5.80.

Anda boleh membelinya di mana-mana cawangan Pos Shop, untuk tempoh terhad bermula 27 Januari 2026, selagi stok masih ada. Kaedah pembayaran yang diterima termasuk secara tunai, pembayaran QR, Kad Debit dan Kad Kredit. Pembayaran menggunakan baucar adalah tidak dibenarkan.

- Setiap resit yang layak hanya berhak menerima satu (1) paket angpow percuma, tanpa mengira jumlah perbelanjaan yang lebih tinggi (seperti RM40, RM60, RM80 dan ke atas).

- Perbelanjaan minimum RM20 mesti dalam satu (1) resit dalam tempoh promosi bermula 27 Januari 2026.

Penebusan sah bermula 27 Januari 2026 dan tertakluk kepada stok yang ada. - GWP tidak sah untuk transaksi/pembelian berikut:

- Barangan rasmi Pos Malaysia

- Pembayaran bil

- Tambah nilai mudah alih

- Rokok dan produk tembakau

- Barangan elektronik

- Pembayaran menggunakan baucar tidak dibenarkan.

- Gabungan resit daripada hari yang berbeza adalah tidak dibenarkan.

Ya. Pelanggan boleh membeli Angpow pada harga RM5.80 dan masih menerima GWP percuma sekiranya memenuhi perbelanjaan minimum RM20 dalam satu resit.

This campaign is a collaboration between Pos Malaysia and Shopee SPayLater (managed by Monee Capital Malaysia Sdn Bhd) (“the Organiser”). Customers who renew their vehicle insurance through Pos Malaysia, whether online or at any Pos Malaysia counter, and make their payment using SPayLater, can enjoy exclusive benefits such as a 0% instalment fee for the 3 month instalment plan OR a discount of up to 10% (capped at RM50), subject to quota.

The campaign runs from 10 December 2025 until 9 March 2026.

All SPayLater users that perform transaction at Post offices and Online at Insurance.pos.com.my.

There are two types of rewards:

- A 0% instalment fee for customers who select the 3-month SPayLater instalment plan.

- A discount of up to 10% (capped at RM50), on a first come first served basis.

The above benefits are only possible with SPayLater.

- The 0% instalment fee is exclusive to vehicle insurance renewals made online or at the counter with Pos Malaysia, with a minimum renewal amount of RM500.

- The 10% discount (capped at RM50) applies to any insurance renewal or item paid using SPayLater during the campaign period.

Each user is entitled to one discount per month throughout the campaign period.

The applicable reward will be displayed directly on the payment page before the transaction is confirmed.

Yes. All benefits are subject to the monthly and overall quota set by the Organiser. Once the quota is reached, the reward will no longer be displayed. Rewards will cease immediately once the quota is fully redeemed or when the campaign period ends, whichever comes first.

For more information, please refer to the Campaign Terms & Conditions on the Pos Malaysia website.

Kempen ini merupakan kerjasama antara Pos Malaysia dan Shopee SPayLater (diuruskan oleh Monee Capital Malaysia Sdn Bhd) (‘Penganjur’) di mana pelanggan yang memperbaharui insurans kenderaan melalui Pos Malaysia secara atas talian ataupun di kaunter Pos Malaysia dan membuat bayaran menggunakan SPayLater boleh menikmati manfaat istimewa seperti kadar faedah 0% untuk pelan pembayaran ansuran 3 bulan ATAU diskaun sehingga 10% peratus (terhad sehingga RM50), tertakluk kepada kuota.

Kempen berlangsung dari 10 Disember 2025 hingga 9 Mac 2026.

Semua pengguna SPayLater yang membuat transaksi di pejabat pos atau secara dalam talian di insurance.pos.com.my.

Terdapat dua jenis ganjaran:

- Kadar faedah 0% untuk pelanggan yang memilih pelan ansuran 3 bulan SPayLater.

- Diskaun sehingga 10% (terhad sehingga RM50), mengikut konsep siapa cepat dia dapat.

Nikmati ganjaran-ganjaran di atas hanya dengan SPayLater.

- Kadar faedah 0% adalah eksklusif untuk pembaharuan insurans kenderaan Pos Malaysia secara atas talian ataupun di kaunter Pos Malaysia dengan nilai pembaharuan minimum RM500.

- Diskaun 10% adalah terpakai untuk mana-mana pembaharuan insurans atau item yang dibayar menggunakan SPayLater sepanjang tempoh kempen.

Setiap pengguna layak menikmati satu diskaun setiap bulan sepanjang tempoh kempen.

Ganjaran yang layak akan dipaparkan terus pada halaman pembayaran sebelum transaksi disahkan.

Ya. Semua manfaat adalah tertakluk kepada kuota bulanan dan kuota keseluruhan yang ditetapkan oleh penganjur. Setelah kuota dipenuhi, ganjaran tidak lagi dipaparkan. Ganjaran akan dihentikan serta merta apabila kuota habis atau apabila tempoh kempen tamat, yang mana lebih awal.

Untuk maklumat lanjut, sila rujuk terma & syarat Peraduan di laman sesawang Pos Malaysia.

Redly Express offers premium international courier services for documents and merchandise, including special handling deliveries to over 200 destinations worldwide

Redly Express accept non-dangerous liquids or non-solid items (non-DG) listed in Common Items List or accompanied by proper documentation (MSDS)

Customers must fill in the Redly Express e-consignment note and submit it together with the item at a Post Office Counter

- Door-to-door delivery

- Proof of Delivery upon customer’s request

- Can accept non-dangerous liquids or non-solid items listed in the Common Items List or with proper MSDS documentation

Refer to prohibited items poster or www.pos.com.my for more details

No, Redly Express does not accept shipments containing sea cucumber or bird’s nest.

No, dangerous goods are prohibited.

Material Safety Data Sheet is a document containing chemical information (physical/chemical properties, hazards, handling methods, and emergency measures). MSDS must be in English.

Usually issued by product manufacturers/producers, or available from agencies such as SIRIM.

Highly viscous liquids, e.g. face creams, body lotion, hair gel

Yes, if accompanied by an MSDS confirming non-DG status

Yes, if documents are incomplete or if items are falsely declared

- Documents: Loose papers bound by one stapler/clip, ≤2kg

- Merchandise: Anything else, ≤30kg, subject to volumetric weight

Visit www.pos.com.my

Based on:

- Item classification (Document/Merchandise)

- Destination country

- Actual or volumetric weight (whichever is higher)

Formula: (Length × Width × Height) ÷ 5000

No. All merchandise is subject to volumetric weight

No. All merchandise is subject to volumetric weightWeight: 30kg

Size: Up to 180cm. Items between <120cm–180cm incur RM271 surcharge

Depends on:

- Destination country

- Customs clearance

- Outskirt Delivery Area (ODA)

Refer to Delivery Time Chart at www.pos.com.my

Remote/distant delivery areas.

Yes, at www.pos.com.my

The sender.

- Fill sender/receiver details clearly in Roman letters

- Use secure packaging

- Ensure item is not prohibited

- Provide Proforma/Commercial invoice for Customs declaration

- Use strong, durable, cushioned materials

- No rattling sounds when shaken

- No leakage

- Do not only use string

- Label Fragile/Handle with Care for breakables (still requires proper packaging)

Possibly, depending on Customs assessment in the destination country.

Usually based on declared value or contents.

The recipient.

- Must be made in writing by sender (or authorized party)

- Damaged/partially lost items: Report within 48 hours at Post Office/Pos Laju Centre/destination courier agent with proof (photos).

- Lost items: Written claim within 30 days of posting.

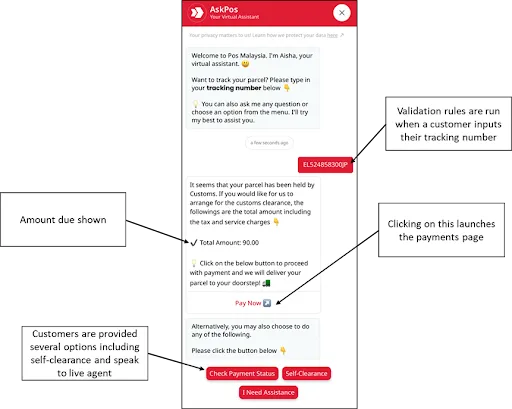

- Submit via AskPos at www.pos.com.my

- One claim per shipment, subject to maximum liability

- Claims after expiry will not be accepted

- Actual value OR

- Max RM100 (documents ≤2kg)

- Max RM300 (merchandise ≤30kg)

- Whichever is lower.

Yes, Pos Service Warranty can be purchased at Post Office counters during posting.

Up to RM5,000.

For any inquiries, customers can contact via the following channels:

- Contact 1-300-300-300 (Customer Service Line)

- AskPos Chatbot (Let’s Chat!): AskPos

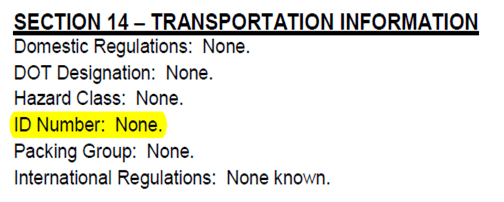

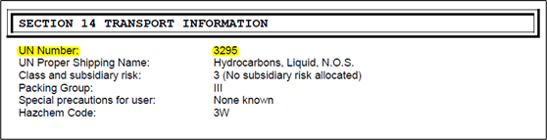

Check the “Transport Information” section in the MSDS.

Non-DG items have no UN number

i. MSDS Non-DG Item

ii. MSDS DG Item

Yes, provided they are in the Common Items List or accompanied by an MSDS confirming they are non-dangerous

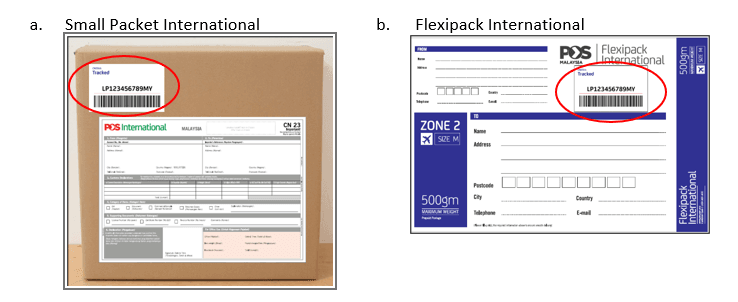

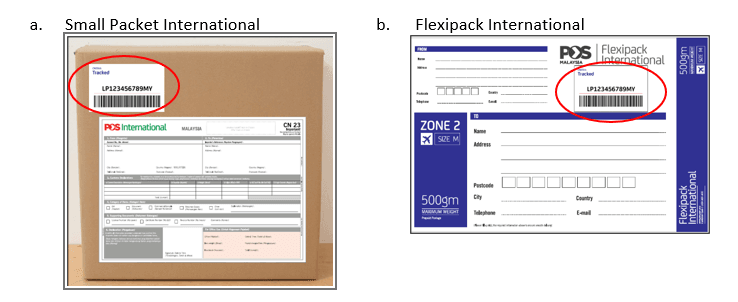

Tracked label is a new tracking option of using label stickers with barcode that has Track and Trace feature for International Small Packet and Flexipack International.

Tracked label can be used for posting to selected destination countries as follows:

| 1 | Australia | 14 | Germany | 27 | Malta | 40 | Slovenia | 53 | Dominican Rep. |

| 2 | Austria | 15 | Greece | 28 | Mauritius | 41 | South Africa | 54 | Egypt |

| 3 | Belarus | 16 | Hong Kong | 29 | Mexico | 42 | Spain | 55 | Georgia |

| 4 | Belgium | 17 | Hungary | 30 | Netherlands | 43 | Sweden | 56 | Gibraltar |

| 5 | Brazil | 18 | India | 31 | New Zealand | 44 | Switzerland | 57 | Iceland |

| 6 | Canada | 19 | Indonesia | 32 | Norway | 45 | Thailand | 58 | Jersey |

| 7 | China | 20 | Ireland | 33 | Philippines | 46 | Turkey | 59 | Korea |

| 8 | Croatia | 21 | Italy | 34 | Poland | 47 | United Kingdom | 60 | Luxembourg |

| 9 | Cyprus | 22 | Japan | 35 | Portugal | 48 | United States | 61 | Slovakia |

| 10 | Denmark | 23 | Latvia | 36 | Russia | 49 | Vietnam | 62 | Solomon Islands |

| 11 | Estonia | 24 | Lebanon | 37 | Saudi Arabia | 50 | Aruba | 63 | Swaziland |

| 12 | Finland | 25 | Lithuania | 38 | Serbia | 51 | Bhutan | 64 | Taiwan |

| 13 | France | 26 | Macao | 39 | Singapore | 52 | Curacao | 65 | Tuvalu |

6 to 11 working days.

- Mail drop delivery to recipient’s letter box with online tracking feature.

- Suitable for lightweight e-Commerce items up to 500 g.

New price effective 14 January 2020 is RM13.50 (not inclusive of postage).

Customer is required to purchase the Tracked label and affix it on the front of the International Small Packet and Flexipack International before posting

- Post Office and General Post Office counters

- Pos-on-Wheels (POW)

- PosBOX Branch (Bangsar South only)

- Available online at https://pos.com.my/shop

Yes, discounts are only available for bulk purchase of Tracked label via https://pos.com.my/shop (terms and condition apply).

- Post Office and General Post Office counters

- Pos-on-Wheels (POW)

- PosBOX Branch (Bangsar South only)

No.

No.

No signature of recipient is required for Proof of Delivery (POD) because it is a mail drop delivery to the recipient’s letter box. However, the barcode at the Tracked label is scanned during the mail drop delivery for record in the Track and Trace system.

No liability on compensation for this Tracked service.

No.

Yes, the item will be returned to the sender if it is still in good condition and the sender’s full complete address is written clearly on the package.

No.

The price increase of the Tracked label is because of the rising operating costs since its introduction in 2017.

- use our e-feedback form

- Visit Facebook Facebook.com/PosMalaysiaBerhad

- Visit Twitter Twitter.com/Pos4you

- Visit website www.pos.com.my

A service for sending registered and barcoded letters or small packages for tracking and tracing purposes

RM10.50 (not inclusive of postage).

a. All Post Office counters and major Post Offices

b. All Pos Mini branches

c. Post On Wheel (POW)

Yes (RM0.20). However, the discount will only be given if the customer purchases a minimum of RM1,000.00 worth of Flexipack International.

a. A registered and barcoded delivery service

b. Tracking and tracing

a. Post office counters

b. Pos Daftar counters at the Business Mail Centre (for bulk posting)

c. All Pos Mini branches

d. Post On Wheel (POW)

Posting via mailbox is not allowed.

Yes, customers need to inform the counter clerk during the posting to add-on for insurance.

The minimum allowed insurance amount is RM100 while the maximum amount is RM3000, subject to the destination country (refer to Appendix A).

- The envelope should be sturdy and undamaged, and there should be no signs that the envelope has been opened or resealed.

- Postal items such as packages that are not sealed with adhesive tape must be securely tied with a string. The tying string for printed matter, including newspapers, to be registered must be able to be untied for inspection, according to the regulations governing the sending of postal items.

- The full name and address of the recipient must be clearly written in Roman letters.

- The posting should not violate the regulations for sending postal items.

- Sufficient payment for the Pos Daftar service and postage fee.

Not all country shared their tracking information.

The shipment status can be checked via:

- The Track and Trace system on the Pos Malaysia website.

- Contacting the POSLINE customer service hotline at 1-300-300-300.

Yes.

No, it cannot.

The maximum compensation value is RM92.00.

Inquiries or compensation claims must be made within 6 months from the date of posting. Customers need to:

- Fill out the Customer Feedback Form (PP1 Form).

- Attach the postage receipt

Inquiries, complaints, or claims regarding International Registered items will not be entertained.

use our e-feedback form

Visit Facebook Facebook.com/PosMalaysiaBerhad

Visit Twitter Twitter.com/Pos4you

Visit website www.pos.com.my

No, compensation will only be given in the case of damage or loss of the registered item/letter.

Redly Priority is an international delivery service for documents up to 1 kg and merchandise up to 30kg offered by Pos Malaysia. Redly Priority is backed by the largest postal network and provides express delivery service to over 200 countries worldwide at an affordable price.

For more info, please submit your inquiry via:

- Call 1-300-300-300 (Customer Service Hotline)

- Chatbot AskPos (Let’s Chat!): https://www.pos.com.my/contact-us/#AskPos

The formula to calculate volumetric weight is:

Volumetric Weight = (Length* x Width* x Height*) / 5000

*Measurement in centimeters (cm)

Tax or duty is not included in the postage price. If the item is subjected to tax or duty in the destination country, the relevant authority will contact the receipient for such payment.

Yes, there is a total of 25% surcharge applicable for Redly Priority.

Destination countries are divided into 8 zones. The zoning for document and merchandise is different. Customers can refer to ‘Redly Priority - Zones’ at Pos Malaysia Website for details.

- Door-to-door delivery

- Track and trace

- Proof of delivery

- Optional insurance protection

- Compensation

Customers are not allowed to send prohibited items and dangerous goods via the postal service. For more information, please refer to ‘Prohibited Items’ and ‘Dangerous Goods’ at Pos Malaysia Website for details. Also, please ensure that the import regulations of the destination countries are adhered to.

The estimated delivery time for Redly Priority service is 2 to 11 working days depending on the destination country. Items subjected to customs inspection may incur additional days. Customers can refer to ‘Redly Priority - Delivery Time & Weight Limit’ at at Pos Malaysia Website for details.

Customer needs to fill in all the required information on the Redly Priority Consignment Note (PL1) at https://send.pos.com.my/home/e-connote?lg=en.

This includes:

- Sender and recipient details (name, address, postcode, city, country and phone number)

- Customs Declaration (content, weight, value, etc.)

- Category of item

- Signature and date of posting

There are separate rates for sending document and merchandise and the rates are based on zoning and weight of the item. The weight will be determined by actual or volumetric, whichever is higher. Customers can refer to ‘Redly Priority - Rate’ at Pos Malaysia Website for details.

- Pos Malaysia Outlets nationwide

- SendParcel (https://send.pos.com.my/dashboard?lg=en)

- SendParcel Pro (https://dashboard.pos.com.my/)

There is no compensation for delayed items.

The maximum compensation for document is RM100 or value of the item (whichever is lower). The maximum compensation for merchandise is RM300 or value of the item (whichever is lower).

The latest price revision for Redly Priority was on 1 October 2024.

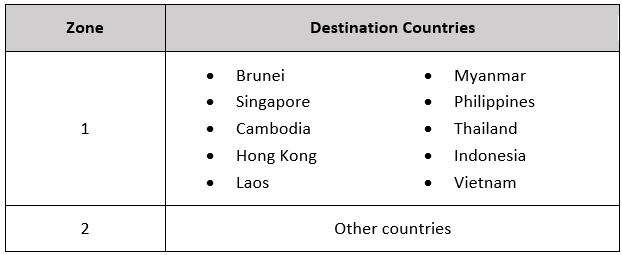

Destination countries are divided into two zones as shown in the table below.

Zone | Destination Countries | |

1 |

|

|

2 | Other countries | |

REDLY CONNECT - FLEXIPACK INTERNATIONAL does not have insurance coverage. However, customer can opt for insurance if the REDLY CONNECT - FLEXIPACK INTERNATIONAL item is using Registered service.

REDLY CONNECT - FLEXIPACK INTERNATIONAL does not have POD unless it is using the Registered service

The excess weight charge applies to all sizes of REDLY CONNECT - FLEXIPACK INTERNATIONAL except Size M (500 g) for Zone 1 and Zone 2 because the maximum weight limit for REDLY CONNECT - FLEXIPACK INTERNATIONAL is 500 g only.

REDLY CONNECT - FLEXIPACK INTERNATIONAL does not have track and trace feature. This feature is only available if the REDLY CONNECT - FLEXIPACK INTERNATIONAL item is using Registered or Tracked service (terms and conditions apply)

- AskPos at www.pos.com.my

- Visit Facebook www.facebook.com/PosMalaysiaBerhad

- Visit Twitter www.twitter.com/Pos4you

- Visit website www.pos.com.my

No.

Cash payment only at post office counters and online payment for purchase via pos.com.my/shop

Customers are not allowed to send prohibited and dangerous goods. Refer to https://www.pos.com.my/send/pos-laju/international/prepaid/flexipack.html. Also, please ensure that the import regulations of the destination country are adhered to

REDLY CONNECT - FLEXIPACK INTERNATIONAL is a prepaid product introduced by Pos Malaysia for sending items not more than 500 g to an overseas destination by air. It comes in 3 different sizes of prepaid envelopes to suit customer’s need.

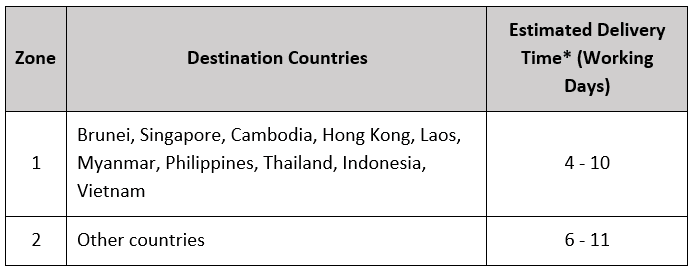

Please refer to the table below for the estimated delivery time for REDLY CONNECT - FLEXIPACK INTERNATIONAL.

| Zone | Destination Countries | Estimated Delivery Time* (Working Days) |

1 | Brunei, Singapore, Cambodia, Hong Kong, Laos, Myanmar, Philippines, Thailand, Indonesia, Vietnam | 4 - 10 |

2 | Other countries | 6 - 11 |

Please fill in the sender and recipient details (name, address, postcode, city, country and phone number). Also, please fill in the Customs Declaration Form CN23 on the back of the envelope/box

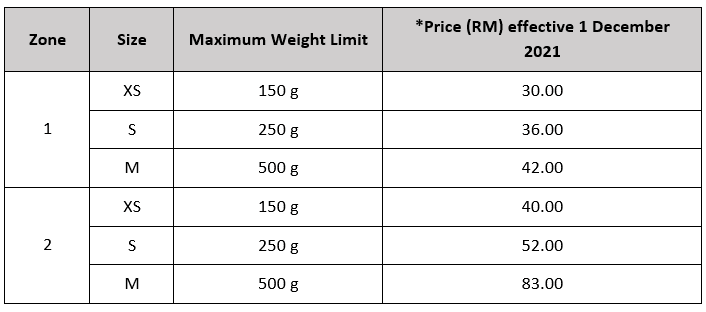

Zone | Size | Maximum Weight Limit | *Price (RM) effective 1 December 2021 |

1 | XS | 150 g | 30.00 |

S | 250 g | 36.00 | |

M | 500 g | 42.00 | |

2 | XS | 150 g | 40.00 |

S | 250 g | 52.00 | |

M | 500 g | 83.00 |

* REDLY CONNECT - FLEXIPACK INTERNATIONAL published rate above is subject to 20% additional surcharge in Ringgit Malaysia (RM) and imposed during posting.

The price increase of REDLY CONNECT - FLEXIPACK INTERNATIONAL is because of the rising operating costs since its introduction in 2013

It will not be processed and will be returned to sender

- Post Office counters

- Pos-on-Wheels (POW)

- PosBOX Branch (Bangsar South only)

- Post Office counters

- Pos-on-Wheels (POW)

- PosBOX Branch (Bangsar South only)

- Available online at pos.com.my/shop

Customer needs to ensure that the weight of the item does not exceed the weight limit based on the sizes of the REDLY CONNECT - FLEXIPACK INTERNATIONAL used. If exceeds, an excess weight charge will be imposed to the customer as follows during posting:

Zone | *Excess weight charge for every additional 10 g |

1 | RM0.50 |

2 | RM1.00 |

*Excess Weight charge for every additional 10g

There is no compensation for delayed items.

No compensation for lost or damaged items unless they are using the Registered service (terms and conditions apply).

No, volumetric weight does not apply for this service.

For more info, please submit your inquiry via:

- Call 1-300-300-300 (Customer Service Hotline)

- Chatbot AskPos (Let’s Chat!):

- https://www.pos.com.my/contact-us/#AskPos

Only Redly Connect - International Parcel (By Air) is available at SendParcel.

Tax or duty is not included in the postage price. If the item is subjected to tax or duty in the destination country, the relevant authority will contact the recipient for such payment.

Effective 1 October 2024, the 20% surcharge for Redly Connect - International Parcel (By Air) has been removed.

Destination countries are divided into 8 zones for Redly Connect - International Parcel (By Air) and Redly Connect - International Parcel (By Surface). Customers can refer to ‘Redly Connect - International Parcel (By Air) - Zone’ and ‘Redly Connect - International Parcel (By Surface) - Zone’ at Pos Malaysia Website for details.

Below are the features of International Parcel:

- Door-to-door delivery

- Track and trace

- Proof of delivery

- Optional insurance protection

Customers are not allowed to send prohibited items and dangerous goods via the postal service. For more information, please refer to ‘Prohibited Items’ and ‘Dangerous Goods’ at Pos Malaysia Website or scan the QR Code below for details. Also, please ensure that the import regulations of the destination countries are adhered to.

Redly Connect - International Parcel is an economy delivery service from Pos Malaysia for sending big, bulky and heavy items up to 30 kg to over 200 countries worldwide either by air or surface (sea).

Both services come with track and trace features but Redly Connect - International Parcel (By Surface) is the least expensive option with longer delivery time if compared to Redly Connect - International Parcel (By Air).

The estimated delivery time for Redly Connect - International Parcel (By Air) service is 5 to 16 working days and for Redly Connect - International Parcel (By Surface) is 3 to 18 weeks depending on the destination country. Items subjected to customs inspection may incur additional days. Customers can refer to ‘Redly Connect - International Parcel (By Air) - Delivery Time & Weight Limit / Redly Connect - International Parcel (By Surface) - Delivery Time & Weight Limit’ at Pos Malaysia Website for details.

Customer needs to fill in all the required information on the Redly Connect - International Parcel Consignment Note (R&P24). This includes:

- Sender and recipient details (name, address, postcode, city, country and phone number)

- Customs Declaration (content, weight, value etc.)

- Category of item

- Services

- By air

- By Surface (sea)

- Signature and date of posting

Effective 1 October 2024, the rates for Redly Connect - International Parcel (By Air) have been revised to Introduce new, lower pricing for the top 10 destinations compared to the current pricing. The rates for Redly Connect - International Parcel are based on zoning and actual weight of the item.

- Pos Malaysia Outlets nationwide

- SendParcel (https://send.pos.com.my/dashboard?lg=en)

- SendParcel Pro (https://dashboard.pos.com.my/)

There is no compensation for delayed items.

The maximum compensation for document is RM100 or value of the item (whichever is lower). The maximum compensation for merchandise is RM300 or value of the item (whichever is lower).

Redly Connect - International Small Packet does not have insurance coverage. However, customer can opt for insurance if the Redly Connect - International Small Packet item is using Registered service.

No. Stamp is not allowed for Redly Connect - International Small Packet postage payment

Redly Connect - International Small Packet does not have POD unless it is using the Registered service.

Redly Connect - International Small Packet does not have track and trace feature. This feature is only available if the Redly Connect - International Small Packet item is using Registered or Tracked service (terms and conditions apply).

- AskPos at www.pos.com.my

- Visit Facebook www.facebook.com/PosMalaysiaBerhad

- Visit Twitter www.twitter.com/Pos4you

No

Customers need to fill in the CN23/CN22 form that available at the counter

Customers are not allowed to send prohibited items and dangerous goods via the postal service. For more information, please refer to ‘Prohibited Items’ and ‘Dangerous Goods’ at Pos Malaysia Website or scan the QR Code below for details. Also, please ensure that the import regulations of the destination countries are adhered to.

It will not be processed and will be returned to sender.

Redly Connect - International Small Packet is a service introduced by Pos Malaysia for sending items not more than 500g to an overseas destination by air.

Please refer to the table below for the estimated delivery time and rate for Redly Connect - International Small Packet:

| Zone | Countries | Estimated Delivery Time (Working Days) | Rate (RM)* | |

| 250g | 500g | |||

1 | Brunei, Singapore, Laos, Cambodia, Myanmar, Thailand, Philippines, Indonesia, Vietnam | 4 - 10 | 35.00 | 39.90 |

2 | Afghanistan, Australia, Bangladesh, Bhutan, China, Christmas Island, Cocos Island, Fiji, Hong Kong, India, Japan, North Korea, South Korea, Macao, Maldives, Nepal, New Zealand, Cook Islands, Niue Islands, Tokelau Islands, Norfolk Islands, Pakistan, Papua New Guinea, Sri Lanka, Timor Leste, Taiwan | 5 - 11 | 45.00 | 75.00 |

3 | Other Countries | 6 - 11 | 50.00 | 82.00 |

* Redly Connect - International Small Packet published rate above is subject to 20% additional surcharge in Ringgit Malaysia (RM). The estimated delivery time listed applies to major cities only. Delivery to area outside of major cities may incur additional days. Delivery time is also subject to custom clearance process.

For Registered & Tracked items, an additional day is needed because it is a recorded delivery service.

Please fill in the sender and recipient details (name, address, postcode, city, country, and phone number). Also, please fill in the Customs Declaration section on CN23/CN22 form. Please refer ‘Customs Declaration’ FAQ at https://www.pos.com.my/faq/ for details.

Cash payment only

Minimum : 140mm (P) x 90mm(L) x 1mm (T)

Maximum : 600mm (P)

(P) + (2L) + (2T) ≤ 900mm

- Ordinary REDLY CONNECT SMALL PACKET INTERNATIONAL

- REDLY CONNECT SMALL PACKET INTERNATIONAL + Registered Label

- REDLY CONNECT SMALL PACKET INTERNATIONAL + Tracked label

- Post Office counters

- Pos-on-Wheels (POW)

- PosBOX Branch (Bangsar South only)

- National Mel Centre (NMC) for posting in bulk

The package will be deferred, and the package may or may not be opened by the relevant agency in the destination country if the package is in doubt.

There is no compensation for delayed items.

No compensation for lost or damaged items unless they are using the Registered service (terms and conditions apply).

For items posted on or after 15 August 2025, compensation for loss or damage will be revised from RM300 to RM200, or the declared value, whichever is lower.

If your parcel is valued at more than RM200, we recommend purchasing the Pos Service Warranty, which provides extended coverage of up to RM5,000, for added peace of mind.

This revision pertains to the General Terms and Conditions (GTC) for domestic Pos Laju parcels. Please note that certain services or products may be governed by their own Specific Terms and Conditions (STC) or additional provisions, which may supplement or take precedence over the GTC, including this revision, where applicable.

Pos Service Warranty is an optional service that offers coverage for loss or damage up to RM5,000. To learn more about coverage, exclusions, and packaging guidelines, please refer to the information page according to your delivery type:

In the event of loss or damage, compensation will be capped at RM200 or the declared value, whichever is lower, even if the actual value is higher.

Eligible domestic Pos Laju parcels come with compensation coverage of up to RM200. In the unlikely event of a service issue such as loss or damage, we encourage you to submit a complaint with the necessary supporting documents. Each complaint will be carefully reviewed, and compensation (in accordance with Terms and Conditions) will be provided for valid and approved cases.

Certain items such as dangerous goods or prohibited items, fragile items without proper packaging, or high-risk goods may not be eligible for compensation or warranty. Please refer to our Terms & Conditions or visit the nearest Pos Malaysia or Pos Laju outlets for more information.

For enquiries, customers can reach out through the following channels:

1. Call 1-300-300-300 (Customer Service Hotline)

2. Chatbot AskPos (Let’s Chat!): AskPos

Flexipack International is being phased out due to challenges with stock management and operational processes. It will be replaced by a more efficient service called Mel Plus International.

We are currently running a final stock clearance campaign for Flexipack International (while stocks last). It will be available for purchase until 31 December 2025.

We kindly request that all customers use up their existing Flexipack International stock and complete any outstanding shipments by 31 December 2026.

As part of the campaign, all Flexipack International SKUs will be standardized into one maximum weight option that allows you to send up to 500g to any international destination at a flat rate of RM48.00 with no additional surcharges at counter during shipment.

*** The published rate for Flexipack International above is a flat rate applicable to all sizes and all available destinations, with no additional surcharges imposed at the time of posting.

We will no longer accept any shipment using Flexipack International effective 1 January 2027.

We are not offering refunds for any unused Flexipack International prepaid. Please make sure to use up your prepaid envelopes and complete all shipments before 31 December 2026.

Yes. All existing Flexipack International prepaid envelopes remain valid and can now be used to send items up to 500g to all available countries regardless of the zone or weight limit stated on the envelope.

No extra payment is required. In fact, you benefit from this upgrade as your prepaid envelope now lets you send items up to 500g without any surcharge to all destination countries available.

You can still use these envelopes without any issue. All prepaid envelopes are now being upgraded to the same maximum weight up to 500g for any destination. The new flat rate of RM48.00 is part of our stock clearance campaign and pricing standardisation. Please note that prices may vary during promotions from time to time, and no refunds or exchanges will be provided.

Yes. Regardless of the original size (150g, 250g, 500g), all Flexipack International envelopes are now valid for maximum weight up to 500g. Just make sure your item fits securely inside the envelope.

No. The 20% surcharge at Pos Malaysia counters has been removed as part of this campaign.

This initiative aims to:

- Simplify the product offering for better customer experience

- Offer greater value with a flat rate for international destinations up to 500g

- Clear existing stock efficiently and transparently

- Prepare for the upcoming launch of our new International Mail Plus product

You can purchase Flexipack International envelopes at:

- General Post Offices (GPO) ONLY

- Pos Malaysia Online Shop (https://shop.pos.com.my)

For any inquiries, please contact us through the following channels:

- Customer Service Line: 1-300-300-300

- AskPos Chatbot (Let’s Chat!): AskPos

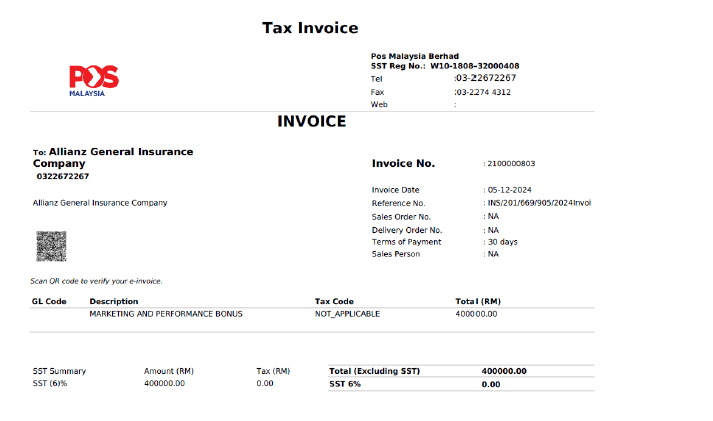

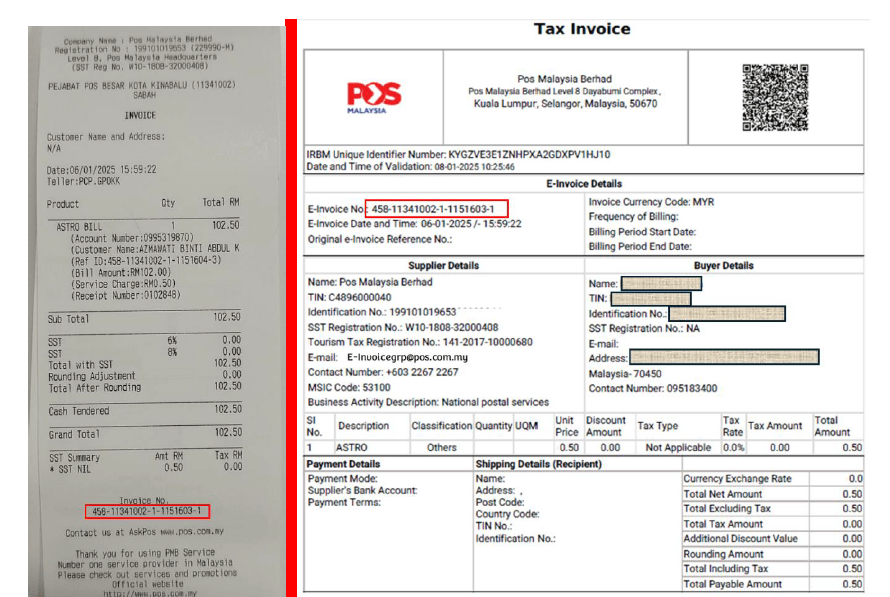

e-Invoice is an initiative by Lembaga Hasil Dalam Negeri (LHDN).

An e-Invoice is a digital representation of a transaction between a supplier and a buyer, formatted in a structured, machine-readable manner. e-Invoice replaces paper or electronic documents such as invoices, credit notes, and debit notes. It also introduced new documents such as refund note, consolidated e-Invoice and self-billed e-Invoice.

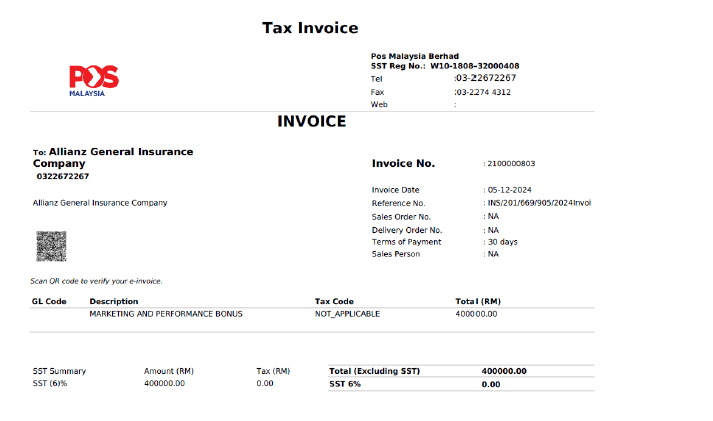

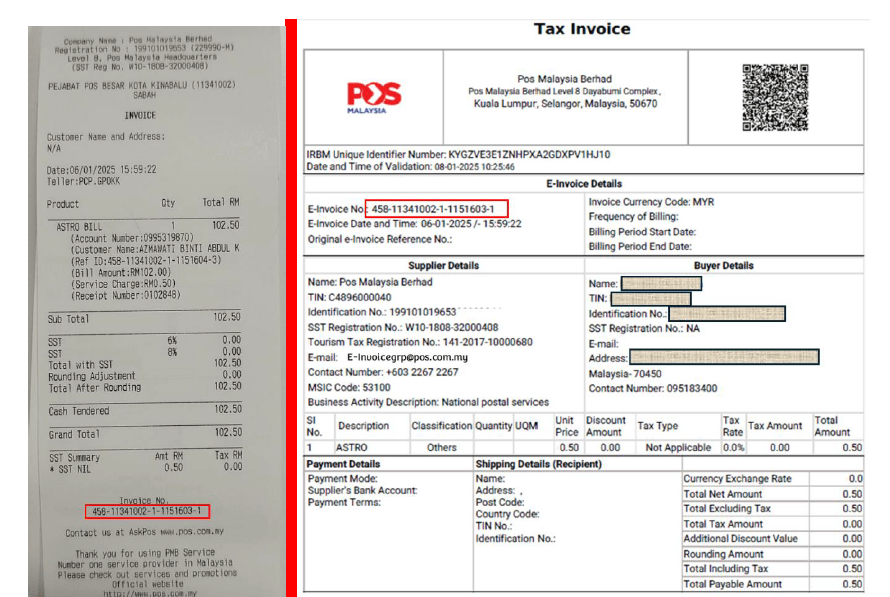

In simpler terms, an e-Invoice is similar to our previous invoices, except that it now requires more information such as Tax Identification Number, SST Registration Number (where applicable), and etc. and must go through LHDN for validation before the final validated e-Invoice embedded with QR code is shared with our customers.

The LHDN e-Invoice mandates that all taxpayers engaged in commercial activities in Malaysia must submit their invoices digitally to a centralized platform (i.e. MyInvoice portal) managed by LHDN for validation before sharing them with the customers. Any invoices or billing documents that fail to undergo LHDN validation will not be considered valid for the purpose of proof of expenses or revenue.

Please refer to the LHDN’s website for further information as follows: -

The e-Invoice must be generated in the form of XML or JSON file format, in accordance with the

requirements outlined by LHDN. Please refer to e-Invoice Software Development Kit (SDK)

microsite via the following link: https://sdk.myinvois.hasil.gov.my for sample of XML or JSON files

The implementation of e-Invoice not only provides a seamless experience for taxpayers, it also improves business efficiency and increases tax compliance. Overall benefits include:

a) Reducing manual effort and human error

b) Facilitating efficient tax filing

c) Streamlining operational efficiency

d) Digitalizing tax and financial reporting

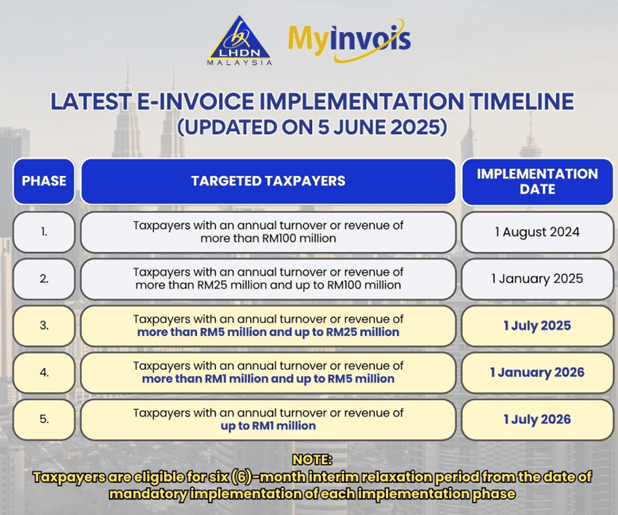

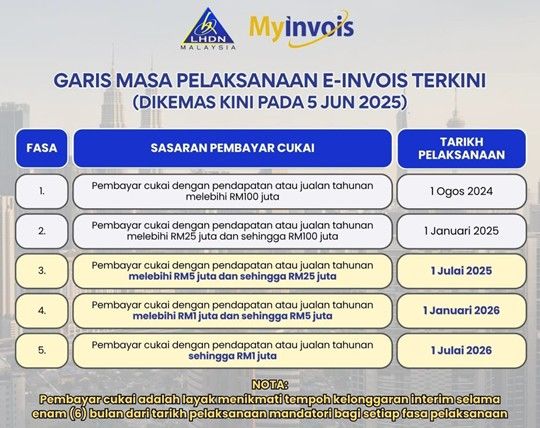

e-Invoice will be implemented in phases to ensure a smooth transition. Below is LHDN’s original e-

Invoice implementation timeline (prior to the relaxation):

Targeted Taxpayers | Implementation Date |

Taxpayers with an annual turnover or revenue of more than RM100 million | 1 August 2024 |

Taxpayers with an annual turnover or revenue of more than RM25 million and up to RM100 million | 1 January 2025 |

All taxpayers | 1 July 2025 |

The 6-month interim relaxation period is applicable for all phases of e-Invoice as follows:

Following the above, the mandatory date of implementation will be on the day immediately after the above periods.

e-Invoice covers typical transaction types such as Business-to-Business (B2B), Business-to-

Consumer (B2C) and Business-to-Government (B2G).

a) Invoice: A commercial document that itemizes and records a transaction between a Supplier and Buyer, including the issuance of self-billed e-Invoice to document an expense.

b) Credit Note: A credit note is issued by Suppliers to correct errors, apply discounts, or account for returns in a previously issued e-Invoice with the purpose of reducing the value of the original e-Invoice. This is used in situations where the reduction of the original e-Invoice does not involve return of monies to the Buyer.

c) Debit Note: A debit note is issued to indicate additional charges on a previously issued e-Invoice;

d) Refund Note: A refund note e-Invoice is a document issued by a Supplier to confirm the refund of the Buyer’s payment. This is used in situations where there is a return of monies to the Buyer.

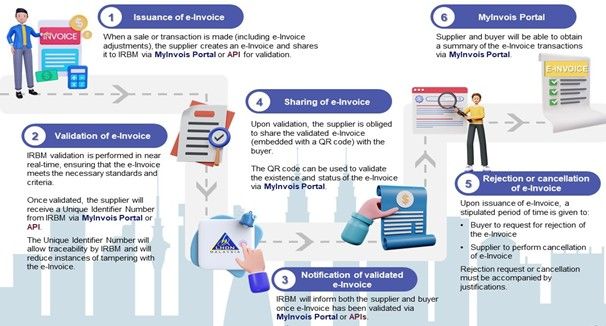

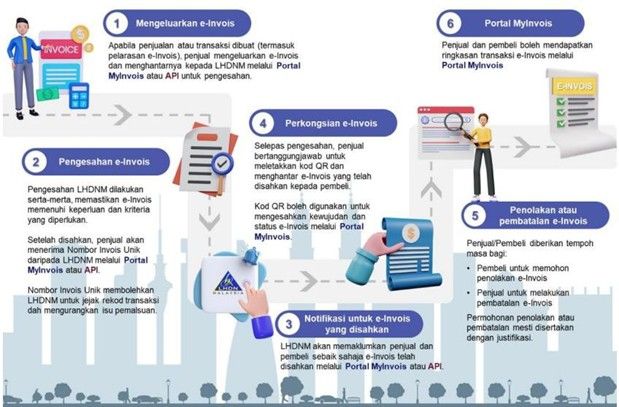

The infographic below demonstrates an overview of the e-Invoice workflow:

LHDN has issued a media release dated 26 July 2024 granting Phase 1 Companies (Companies with annual turnover of more than RM100 million) which includes Pos Malaysia, a 6-month relaxation period from their existing mandatory deadline of 1 August 2024. During this relaxation period, Pos Malaysia will submit monthly consolidated e-Invoices as required by LHDN.

Pos Malaysia will officially begin issuing individual e-Invoices commencing from 1 February 2025 onwards, while we will pilot run some of our systems by mid of January 2025.

Yes, you will still be able to use the current bills from Pos Malaysia for tax deductions. As the e-Invoice implementation is currently in phases and given 6 months relaxation period within each phase, the requirement to have e-Invoice as supporting document for tax deduction has not been made mandatory until such time the legislation is being amended.

Pos Malaysia is committed to providing our customers with a validated e-Invoice from LHDN. We are in the process of upgrading our systems to enhance the e-Invoice issuance process, which we expect to complete by mid / end of January 2025. In the interim, we are collecting essential B2B customer information to ensure that we can issue e-Invoices promptly from 1 February 2025

onwards.

For B2B customers, the e-Invoice will be emailed to the customer.

For B2C customers/walk-in customers, a B2C Customer Portal is made available to request e-Invoice. Customers may scan the QR code provided to request e-Invoices after 48 hours of the transaction time and within the same month.

Scan QR code

Or, click here

The e-Invoice validation by LHDN will be done in near real-time, generally in less than two (2) seconds. However, please expect some delays due to unforeseen circumstances.

| Company Name: | POS Malaysia Berhad |

| Company TIN: | C4896000040 |

| Company Registration Number: | 199101019653 |

| Company SST Registration Number: | W10-1808-32000408 (previously 229990-M) |

| Company Malaysia Standard Industrial Classification (MSIC) Code: | 53100 |

| Company Business Activity Description: | Provide postal and its related services |

Yes. Without the buyer’s information, Pos Malaysia will not be able to generate e-Invoices for B2B transactions or B2C transactions when the buyer requests for an e-Invoice.

For B2C customers, where the customer requests for an e-Invoice to be issued, customers are required to provide their details via the B2C Customer Portal for the purpose of issuing an e-Invoice.

B2B customers are required to fill in their details in advance in the request forms provided by Pos

Malaysia

Please inform your respective account managers or email us at:

a) Poslaju Contract Customer: einvoicing_sap@pos.com.my

b) Mail Contract Customer: einvoicing_mars@pos.com.my

c) Post Office Customers: Chat with us at https://www.pos.com.my/#askpos

You can fill out the form again with the correct details. Please revert to us as soon as possible so that we can issue a validated e-Invoice to you smoothly.

The required details are as follows:

a) Registered Company/Business Name (as Customer of Pos Malaysia)

b) Customer Account Number with Pos Malaysia Berhad

c) Company Tax Identification Number (TIN) registered with LHDN (mandatory)

d) Company's Old Registration Number with SSM (Suruhanjaya Syarikat Malaysia)

e) Company's New Registration Number with SSM or Business Registration Number

(mandatory)

f) Company Sales & Service (SST) Registration Number with Royal Malaysian Customs

Department, if any.

g) E-Invoicing Notification Email Address

h) Name of Primary Contact

i) Primary Contact Number (Office/Mobile)

j) Office Address

If the question is not applicable to you, please fill in “N/A”.

Government agencies are included in the list of those exempted from issuing e-Invoices (including self-billed e-Invoices), but Pos Malaysia still requires the necessary information to prepare e-Invoices for their services provided to the Government, and therefore, we are updating our records.

We understand that Government agencies do not have a Tax Identification Number (TIN). However, a generic TIN has been provided by LHDN which we will use in our e-Invoices.

Yes, LHDN announced that the MyInvois app is available for download on all operating system platforms, including the App Store (for iOS users), Google Play (for Android users), and AppGallery (for Huawei users) allowing users to access and issue e-Invoices.

You may request e-Invoices via the B2C Customer Portal or scan the QR code to be provided on the

receipt/ invoices or standee at post office counters.

For B2C or walk in customers, i.e. individuals, a B2C Customer Portal is made available to request e-Invoices. Customers may scan the QR code provided to request e-Invoices after 48 hours from the transacted time, within the same month.

Scan QR code

Or click here

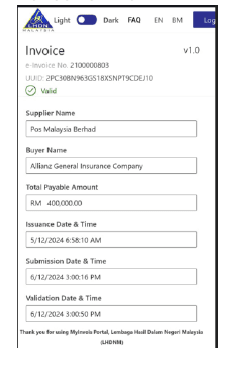

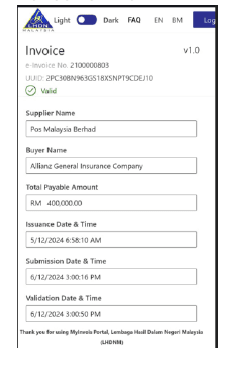

By scanning the QR code on the e-Invoice, you will be directed to the MyInvoice portal, where you can verify the report status.

If there is any error in the e-Invoice, Pos Malaysia will issue a Debit / Credit Note to make the necessary adjustments to the initial e-Invoice/self-billed e-Invoice issued to you, where applicable

The QR code will consist of the following key particulars of the e-Invoice:

• E-Invoice Type

• E-Invoice No

• UUID

• Supplier Name

• Buyer Name

• Total Payable Amount

• Issuance Date and Time

• Submission Date and Time

• Validation Date & Time

Any device (e.g., mobile phone camera, QR code scanner application) capable of scanning a QR code can be used to scan the QR code embedded in the visual representation of e-Invoice generated by MyInvois portal.

Yes, you can within 72 hours of the e-Invoice being issued. However, it is up to Pos Malaysia to approve the cancellation. After the 72 hours, Pos Malaysia will make adjustments through debit or credit notes.

For B2B customers, the e-Invoice will be sent by Pos Malaysia via email if your email address has been provided to us. Please ensure that your emails are updated with us. Kindly also remember to check your junk mailbox.

For B2C customers, an e-Invoice will only be provided upon request via the B2C Customer Portal.

Please contact our Customer Service at: 1300 300 300 or chat with us at https://www.pos.com.my/#askpos for enquiries if you have not received your e-Invoice.

Yes.

There is no minimum purchase value requirement for issuance of e-Invoice.

e-Invoice covers adjustment documents like Credit Note and Debit Note. Adjustment documents will have a reference to the original e-Invoice.

LHDN’s portal may be temporarily unavailable. Please try again later.

If the problem persists, please contact our Customer Service at: 1300300300 or chat with us at

https://www.pos.com.my/#askpos for enquiries if you have not received your e-Invoice.

An e-Invoice can be issued within the same calendar month of the transaction. For example, for transactions that took place on 5 February 2025, Pos Malaysia can issue the e-Invoice for that transaction within the month of February 2025.

B2C customers of Pos Malaysia generally do not require an e-Invoice unless they are claiming the expense as a tax deduction for income tax returns purposes or are required to claim back the expense as a reimbursement from the Company by providing an e-Invoice.

Otherwise, the traditional receipt/invoice will suffice as proof of expense.

For agencies, the normal invoice/ receipt issued by Pos Malaysia will consist of the bill payment portion as well as admin fee charged to customers.

i) For the bill payment portion, the responsibility to issue the e-Invoice will fall on the agencies, not Pos Malaysia;

ii) For the admin fee / service fee portion charged by Pos Malaysia to customers for certain agencies, the e-Invoice will be issued by Pos Malaysia.

Therefore, there will be a difference in amount between the normal invoice /receipt and the e-

Invoice issued by Pos Malaysia.

You may scan the QR code embedded in the sent invoice, and it will direct you to login to the MyInvois portal. You may view your details from the MyInvois portal.

If there is any error in the e-Invoice, Pos Malaysia will issue a Debit / Credit Note to make the necessary adjustments to the initial e-Invoice/self-billed e-Invoice issued to you, where applicable.

For motor insurance, personal accident insurance, life insurance and etc. purchased through Pos Malaysia, the customers must reach out to the respective insurance companies/panel as the obligation to issue e-Invoice lies with the Insurance company.

LHDN has provided TIN search function. It can be accessed from 1 January 2025 via the MyTax Portal and MyInvois Portal https://mytax.hasil.gov.my and click on the “Carian TIN” menu. Taxpayers can do a TIN search by entering information by category as follows:

- Individual: Identification Number (ID Number / Passport Number);

- Non-individuals: Business Registration Number (BRN) or Taxpayer Name registered at HASiL for those who do not have a BRN

You can scan the QR code/URL provided in the invoice or from Pos Malaysia e-Invoice portal (https://www.pos.com.my/e-invoice), which will direct you to log in to the B2C portal.

You will need to enter the Poslaju Consignment Number as the Document Number and the Successful Delivery (POD) Date as the Document Date.

Please fill in your personal details and follow the instructions until the e-Invoice is successfully generated.

Yes, please submit your request before the 3rd of the next month. Requests made after this date will no longer be accepted, and e-Invoices will not be issued.

Example:

For a purchase made on 31st August 2025, the last day to request for e-Invoice is on 3rd September 2025, after which, we are not obligated to issue e-Invoice to customers. Kindly note that a consolidated e-Invoice will be submitted to the IRB by our Company by the 7th of the following month, i.e. by 7 September 2025, for customers who have not requested for e-Invoices.

For more details on how to request an e-Invoice, please refer to Question #11 or #21.

e-Invois adalah inisiatif oleh Lembaga Hasil Dalam Negeri (LHDN).

e-Invois merupakan representasi dalam bentuk digital bagi transaksi antara penjual dan pembeli, dalam format yang berstruktur dan boleh dibaca mesin. e-Invois menggantikan dokumen kertas atau dokumen elektronik seperti invois, nota kredit, dan nota debit. Ia juga memperkenalkan dokumen baharu seperti nota bayaran balik, e-Invois disatukan dan e-Invois bil kendiri.

Dalam istilah yang lebih mudah, e-Invois adalah sama dengan invois sebelum ini, kecuali ia kini memerlukan maklumat tambahan seperti Nombor Pengenalan Cukai, Nombor Pendaftaran SST (jika berkenaan), dan lain-lain, serta mesti melalui LHDN untuk pengesahan sebelum e-Invois yang telah disahkan dan dilengkapi dengan kod QR dikongsi dengan pelanggan kita.

e-Invois LHDN mewajibkan semua pembayar cukai yang terlibat dalam aktiviti komersial di Malaysia untuk mengemukakan invois mereka secara digital ke platform pusat (iaitu portal MyInvoice) yang dikendalikan oleh LHDN untuk pengesahan sebelum dikongsi dengan pelanggan. Sebarang invois atau dokumen yang gagal daripda pengesahan LHDN tidak akan dianggap sah untuk tujuan bukti perbelanjaan atau pendapatan.

Sila rujuk laman web LHDN untuk maklumat lanjut seperti berikut: - e-Invoice | Lembaga Hasil Dalam Negeri Malaysia

e-Invois mesti dijana dalam format fail XML atau JSON, berdasarkan keperluan yang ditetapkan oleh LHDN. Sila rujuk laman mikro Software Development Kit (SDK) e-Invois melalui pautan berikut: https://sdk.myinvois.hasil.gov.my untuk mendapatkan contoh fail XML atau JSON.

Pelaksanaan e-Invois bukan sahaja menyediakan pengalaman yang lancar untuk pembayar cukai, tetapi ia juga meningkatkan kecekapan perniagaan dan meningkatkan pematuhan cukai. Manfaat keseluruhan termasuk:

- Mengurangkan usaha manual dan kesilapanmanusia

- Mempermudahkan pengisytiharan cukai yang efisien

- Menyelaraskan kecekapan operasi

- Mendigitalkan pelaporancukai dan kewangan

Pelaksanaan e-Invois akan dilaksanakan secara berperingkat bagi memastikan peralihan yang lancar. Berikut adalah garis masa pelaksanaan e-Invois asal LHDN (sebelum kelonggaran diberikan):

Sasaran Pembayar Cukai | Tarikh Pelaksanaan |

Pembayar cukai dengan perolehan tahunan atau hasillebih daripada RM100juta | 1 Ogos 2024 |

Pembayar cukai denganperolehan tahunan atau hasil lebih daripada RM25 juta dan sehingga RM 100 juta | 1 Januari 2025 |

Semua pembayarcukai | 1 Julai 2025 |

Tempoh kelonggaran sementara selama 6 bulan melibatkan semua fasa e-Invois seperti berikut:

e-Invois meliputi jenis transaksi biasa seperti Perniagaan-ke-Perniagaan (B2B), Perniagaan-ke Pengguna (B2C), dan Perniagaan-ke-Kerajaan (B2G).

- Invois: Dokumen komersial yang menyenaraikan dan merekodkan transaksi antara Penjual dan Pembeli, termasuk pengeluaran e-Invois bil kendiri untuk mendokumenkan perbelanjaan.

- Nota Kredit: Nota kredit dikeluarkan oleh penjual untuk membetulkan kesilapan, memberikan diskaun, atau merekodkan pemulangan dalam e-Invois yang telah dikeluarkan sebelum ini dengan tujuan untuk mengurangkan nilai e-Invois asal. Ini digunakan dalam situasi di mana pengurangan nilai e-Invois asal tidak melibatkan pemulangan wang kepada Pembeli.

- Nota Debit: Nota debit dikeluarkan untuk menunjukkan caj tambahan dalam e-Invois yang telah dikeluarkan sebelum ini.

- Nota Bayaran Balik: Nota bayaran balik e-Invois adalah dokumen yang dikeluarkan oleh Penjual untuk mengesahkan pemulangan pembayaran yang telah dibuat oleh Pembeli. Ini digunakan dalam situasi di mana terdapat pemulangan wang kepada Pembeli.

Infografik di bawah menunjukkan gambaran keseluruhan aliran kerja e-Invois:

LHDN telah mengeluarkan kenyataan media bertarikh 26 Julai 2024 yang memberikan tempoh kelonggaran selama 6 bulan kepada Syarikat Fasa 1 (Syarikat dengan perolehan tahunan lebih daripada RM100 juta), termasuk Pos Malaysia, daripada tarikh akhir wajib yang ditetapkan pada 1 Ogos 2024. Sepanjang tempoh kelonggaran ini, Pos Malaysia akan mengemukakan e-Invois disatukan seperti yang dikehendaki oleh LHDN.

Pos Malaysia akan mula mengeluarkan e-Invois individu secara rasmi bermula 1 Februari 2025, dan menjalankan ujian rintis untuk beberapa sistem kami pada pertengahan bulan Januari 2025.

Ya, anda masih boleh menggunakan bil semasa dari Pos Malaysia untuk potongan cukai. Memandangkan pelaksanaan e-Invois dijalankan secara berperingkat dan diberikan tempoh kelonggaran 6 bulan dalam setiap fasa, keperluan untuk mempunyai e-Invois sebagai dokumen sokongan bagi potongan cukai belum diwajibkan sehingga pindaan undang-undang dilakukan.

Pos Malaysia komited untuk menyediakan e-Invois yang telah disahkan oleh LHDN kepada pelanggan. Kami sedang dalam proses menaik taraf sistem untuk meningkatkan proses pengeluaran e-Invois, yang dijangka selesai pada pertengahan/ penghujung bulan Januari 2025. Sementara itu, kami sedang mengumpul maklumat penting pelanggan B2B untuk memastikan kami dapat mengeluarkan e-Invois dengan segera mulai 1 Februari 2025.

Untuk pelanggan B2B, e-Invois akan dihantar melalui e-mel kepada pelanggan.

Untuk pelanggan B2C/pelanggan walk-in, Portal Pelanggan B2C disediakan untuk membuat permintaan e-Invois. Pelanggan boleh mengimbas kod QR yang disediakan untuk meminta e-Invois selepas 48 jam waktu transaksi dan dalam bulan yang sama.

Imbas Kod QR

Pengesahan e-Invois oleh LHDN akan dilakukan hampir secara masa nyata, secara amnya dalam masa kurang daripada dua (2) saat. Walau bagaimanapun, ia mungkin mengambil masa yang lebih lama disebabkan oleh halangan yang tidak dijangka.

Nama Syarikat: | POS MalaysiaBerhad |

TIN Syarikat: | C 4896000040 |

Nombor Pendaftaran Syarikat: | 199101019653 (229990-M) |

Nombor Pendaftaran SST Syarikat: | W10-1808-32000408 |

Kod Klasifikasi Industri Standard Malaysia Syarikat (MSIC): | 53100 |

Butiran Aktiviti Perniagaan Syarikat: | Menyediakan perkhidmatan pos dan perkhidmatan berkaitan |

Ya. Tanpa maklumat pembeli, Pos Malaysia tidak dapat menjana e-Invois untuk transaksi B2B atau transaksi B2C apabila pembeli membuat permintaan untuk e-Invois.

Untuk pelanggan B2C, di mana pelanggan meminta e-Invois dikeluarkan, pelanggan dikehendaki menyediakan butiran mereka melalui Portal Pelanggan B2C bagi tujuan pengeluaran e-Invois.

Pelanggan B2B dikehendaki mengisi butiran mereka terlebih dahulu di dalam borang permintaan yang disediakan oleh Pos Malaysia.

Sila maklumkan kepada pengurus akaun masing-masing atau e-mel kami di:

a) Pelanggan Kontrak Pos Laju: einvoicing_sap@pos.com.my

b) Pelanggan Kontrak Mel: einvoicing_mars@pos.com.my

c) Pelanggan Pejabat Pos: chat kami di https://www.pos.com.my/#askpos

Anda boleh mengisi semula borang dengan butiran yang betul, dan sila maklumkan kepada kami secepat mungkin supaya kami dapat mengeluarkan e-Invois yang disahkan kepada anda.

Butiran yang diperlukan adalah seperti berikut:

a) Nama Syarikat/ Perniagaan Berdaftar (sebagai Pelanggan Pos Malaysia)

b) Nombor Akaun Pelanggan dengan Pos Malaysia Berhad

c) Nombor Pengenalan Cukai Syarikat (TIN) yang didaftarkan dengan LHDN (wajib)

d) Nombor Pendaftaran Lama Syarikat dengan SSM (Suruhanjaya Syarikat Malaysia)

e) Nombor Pendaftaran Baharu Syarikat dengan SSM atau Nombor Pendaftaran Perniagaan (wajib)

f) Nombor Pendaftaran Cukai Jualan & Perkhidmatan (SST) Syarikat dengan Jabatan Kastam Diraja Malaysia, jika ada.

g) Alamat E-mel Pemberitahuan e-Invois

h) Nama Kontak Utama

i) Nombor Telefon Kontak Utama (Telefon Pejabat/ Bimbit)

j) Alamat Pejabat

Jika soalan tidak berkenaan dengan anda, sila isi dengan "N/A".

Agensi kerajaan termasuk dalam senarai yang dikecualikan daripada mengeluarkan e-Invois (termasuk e-Invois bil kendiri), namun Pos Malaysia masih memerlukan butiran tersebut untuk mengeluarkan e-Invois bagi perkhidmatan yang diberikan kepada Kerajaan. Oleh itu, kami sedang mengemas kini rekod kami.

Kami faham bahawa agensi kerajaan tidak mempunyai Nombor Pengenalan Cukai (TIN). Walau bagaimanapun, nombor TIN generik telah disediakan oleh LHDN dan akan digunakan dalam e Invois kami.

Ya, LHDN telah mengumumkan bahawa aplikasi MyInvois boleh dimuat turun di semua platform sistem operasi, termasuk App Store (untuk pengguna iOS), Google Play (untuk pengguna Android), dan AppGallery (untuk pengguna Huawei), membolehkan pengguna mengakses dan mengeluarkan e-Invois.

Anda boleh memohon e-Invois melalui B2C Customer Portal atau mengimbas kod QR yang akan disediakan dalam resit/invois atau ‘standee’ di kaunter pejabat pos.

Untuk pelanggan B2C atau pelanggan walk-in, iaitu individu, Portal Pelanggan B2C disediakan untuk membuat permintaan e-Invois. Pelanggan boleh mengimbas kod QR yang disediakan untuk membuat permintaan e-Invois selepas 48 jam dari masa transaksi, dalam bulan yang sama.

Imbas kod QR

Atau Klik sini

Dengan mengimbas kod QR pada e-Invois, anda akan diarahkan ke portal MyInvoice, di mana anda boleh menyemak status laporan tersebut.

Jika terdapat sebarang kesilapan dalam e-Invois, Pos Malaysia akan mengeluarkan Nota Debit / Kredit untuk membuat pelarasan yang diperlukan ke atas e-Invois asal / e-Invois bil kendiri yang dikeluarkan kepada anda, jika berkenaan.

Kod QR akan mengandungi butiran berikut bagi e-Invois:

• Jenis E-Invois

• Nombor E-Invois

• UUID

• Nama Penjual

• Nama Pembeli

• Jumlah Bayaran yang Perlu Dibayar

• Tarikh dan Masa Pengeluaran

• Tarikh dan Masa Penyerahan

• Tarikh dan Masa Pengesahan

Mana-mana peranti (contohnya, kamera telefon pintar, aplikasi pengimbas kod QR) yang mampu mengimbas kod QR boleh digunakan untuk mengimbas kod QR yang disediakan dalam representasi visual e-Invois yang dijana oleh portal MyInvois.

Ya, anda boleh melakukannya dalam tempoh 72 jam selepas e-Invois dikeluarkan. Walau bagaimanapun, kelulusan pembatalan adalah tertakluk kepada Pos Malaysia. Selepas 72 jam, Pos Malaysia akan membuat pelarasan melalui nota debit atau kredit.

Untuk pelanggan B2B, Pos Malaysia akan menghantar e-Invois melalui e-mel jika alamat e-mel anda telah diberikan kepada kami. Sila pastikan alamat e-mel anda dikemas kini dengan kami. Sila semak peti mel sampah anda juga.

Untuk pelanggan B2C, e-Invois hanya akan diberikan atas permintaan melalui Portal Pelanggan B2C.

Sila hubungi Perkhidmatan Pelanggan kami di: 1300 300 300 atau hubungi kami di https://www.pos.com.my/#askpos untuk sebarang pertanyaan sekiranya anda tidak menerima e Invois anda.

Ya, e-Invois boleh dicetak.

Tiada keperluan nilai pembelian minimum untuk pengeluaran e-Invois.

e-Invois merangkumi dokumen pelarasan seperti Nota Kredit dan Nota Debit. Dokumen pelarasan ini akan mempunyai rujukan kepada e-Invois asal.

Portal LHDN mungkin sedang tidak tersedia buat sementara waktu. Sila cuba lagi nanti. https://www.pos.com.my/#askpos. Jika masalah masih berterusan, sila hubungi Perkhidmatan Pelanggan kami di: 1300 300 300 atau hubungi kami di https://www.pos.com.my/#askpos untuk sebarang pertanyaan jika anda tidak menerima e-Invois anda.

E-Invois boleh dikeluarkan dalam bulan kalendar yang sama dengan transaksi tersebut. Sebagai contoh, untuk transaksi yang berlaku pada 5 Februari 2025, Pos Malaysia boleh mengeluarkan e Invois untuk transaksi tersebut dalam bulan Februari 2025.

Pelanggan B2C Pos Malaysia secara amnya tidak memerlukan e-Invois kecuali jika mereka membuat tuntutan perbelanjaan sebagai potongan cukai untuk tujuan pengisytiharan cukai pendapatan atau perlu menuntut semula perbelanjaan tersebut daripada Syarikat dengan menyediakan e-Invois.

Resit/invois tradisional sudah memadai sebagai bukti perbelanjaan.

Bagi agensi, invois/resit biasa yang dikeluarkan oleh Pos Malaysia akan merangkumi bahagian pembayaran bil serta yuran pentadbiran yang dikenakan kepada pelanggan.

- Bagi bahagian pembayaran bil, tanggungjawab untuk mengeluarkan e-Invois terletak pada agensi, bukannya Pos Malaysia.

- Bagi bahagian yuran pentadbiran / yuran perkhidmatan yang dikenakan oleh Pos Malaysia kepada pelanggan untuk agensi tertentu, e-Invois akan dikeluarkan oleh Pos Malaysia.

Oleh itu, akan terdapat perbezaan antara amaun invois/resit biasa dan e-Invois yang dikeluarkan oleh Pos Malaysia.

Anda boleh mengimbas kod QR yang disediakan dalam invois yang dihantar, dan ia akan mengarahkan anda untuk log masuk ke portal MyInvois. Anda boleh melihat butiran anda di portal MyInvois.

Jika terdapat sebarang kesilapan dalam e-Invois, Pos Malaysia akan mengeluarkan Nota Debit / Kredit untuk membuat pelarasan yang diperlukan ke atas e-Invois asal / e-Invois bil kendiri yang dikeluarkan kepada anda, jika berkenaan.

Bagi insurans kenderaan, insurans kemalangan diri, insurans hayat dan lain-lain yang dibeli melalui Pos Malaysia, pelanggan perlu menghubungi syarikat insurans/panel yang berkenaan kerana tanggungjawab untuk mengeluarkan e-Invois terletak pada syarikat insurans.

LHDN telah menyediakan perkhidmatan carian Nombor Pengenalan Cukai (TIN). Ia boleh diakses mulai 1 Januari 2025 melalui Portal MyTax dan Portal MyInvois https://mytax.hasil.gov.my dan klik pada menu “Carian TIN”. Pembayar cukai boleh melakukan carian TIN dengan memasukkan maklumat mengikut kategori seperti berikut:

- Individu: Nombor Pengenalan (Nombor ID / Nombor Pasport)

- Selain individu: Nombor Pendaftaran Perniagaan (BRN) atau Nama Pembayar Cukai yang didaftarkan di HASiL bagi mereka yang tidak mempunyai BRN

Anda boleh mengimbas kod QR /URL yang disediakan dalam invois atau melalui portal e-invois Pos Malaysia (https://www.pos.com.my/e-invoice), dimana ia akan mengarahkan anda untuk log masuk ke portal B2C.

Anda perlu memasukkan Nombor Konsaimen Poslaju sebagai Nombor Dokumen dan Tarikh Serahan Berjaya(POD) sebagai Tarikh Dokumen.

Ya, sila kemukakan permohonan anda sebelum 3 haribulan pada bulan berikutnya selepas pembelian. Permohonan yang dibuat selepas tarikh ini tidak akan diterima dan e-Invoice tidak akan dikeluarkan.

Contoh:

Untuk pembelian yang dibuat pada 31 Ogos 2025, hari terakhir untuk memohon e-Invois adalah pada 3 September 2025. Permohonan yang diterima selepas tarikh ini tidak akan dipenuhi. Sila ambil maklum bahawa syarikat kami akan mengemukakan e-Invois terkumpul kepada LHDN selewat-lewatnya pada 7 haribulan pada bulan berikutnya (7 September 2025) bagi pelanggan yang tidak membuat permohonan e-Invois.

Untuk maklumat lanjut mengenai cara memohon e-Invois, sila rujuk Soalan #11 atau #21.

Click here for the details.

Customers can contact our Customer Service team to get assistance with their issue at the channels below:

- AskPos : https://www.pos.com.my/#AskPos

- Call us at 1300-300-300

Bulk Mail is a mail category for sending out 100 pieces of mail and above per lodgement at Bulk Mail Counters (BMC) nationwide, affecting only commercial mail.

The new postage rate for BulkMail will be effective on 1 March 2024.

Weight | Bulk Mail Postage (RM) | |

Standard | Non-Standard | |

| Up to 20g | 1.80 | 2.00 |

| Above 20g to 50g | 1.90 | |

| Above 50g to 100g | - | 2.20 |

| Above 100g to 250g | - | 2.40 |

| Above 250g to 500g | - | 3.50 |

| Above 500g to 1kg | - | 5.00 |

| Above 1kg to 2kg | - | 6.50 |

Mail will either be rejected or embargoed until the account balance is sufficient for deduction.

There are no changes to the rebate structure.

Customers with a minimum posting of 5,000 pieces of standard mail and non-standard mail.

The postage rate increase does not apply to other services such as Franking, Registered Mail, Stamps and Direct Mail.

No. Customers are required to pay the new postage rates effective 1 Mar 2024 without exception.

For further enquiries, please contact the channels below:

- www.pos.com.my

- Email: posmel.BM@pos.com.my

- Bulk Mail Counter (BMC)

Any compensation for loss or damages can only be claimed by the sender or a representative legally agreed by the sender.

Requirements for compensation claim:

- Any compensation claim must be made within 90 days from the date of posting.

- Damage to the goods or loss of part of the content / insufficient content must be reported within 5 working days after the parcel is received by the recipient.

Please prepare and attach these documents when submitting your compensation request:

- Copy of Consignment Note

- Copy of MyKad/Passport

- Copy of Receipt/Proof of Purchase

- Tax Invoice/Posting Receipt

- Copy of Company Registration Certificate (for companies)

- Photos of damage and police report (if necessary)

Here’s how to make a compensation claim:

AskPos : https://www.pos.com.my/#AskPos

You can get further information by contacting us via the channels below:

- AskPos : https://www.pos.com.my/#AskPos

- Call us at 1300-300-300

Destination countries are divided into two zones as shown in the table below.

* Flexipack International published rate above is subject to 20% additional surcharge in Ringgit Malaysia (RM) and imposed during posting.

Please refer to the table below for the estimated delivery time for Flexipack International.

*The estimated delivery time listed applies to major cities only. Delivery to area outside of major cities may incur additional days. Delivery time is also subject to custom clearance process.

For Registered & Tracked items, an additional day is needed because it is a recorded delivery service.

- AskPos at www.pos.com.my

- Visit Facebook www.facebook.com/PosMalaysiaBerhad

- Visit Twitter www.twitter.com/Pos4you

- Visit website www.pos.com.my

Tracked label is a new tracking option of using label stickers with barcode that has Track and Trace feature for International Small Packet and Flexipack International.

Please click here to check the destination countries supported.

Customer is required to purchase the Tracked label and affix it on the front of the International Small Packet and Flexipack International before posting

No.

The price increase of the Tracked label is because of the rising operating costs since its introduction in 2017.

a. use our e-feedback form

b. Visit Facebook Facebook.com/PosMalaysiaBerhad

c. Visit Twitter Twitter.com/Pos4you

d. Visit website www.pos.com.my

For further information on products, you may contact us at the channels below:

- AskPos : https://www.pos.com.my/#AskPos

- Call us at 1300-300-300

Can't find what you're looking for?